Pricing Experimentation Handbook

Intro

Pricing isn’t just a growth lever—it’s the growth lever. Yet, it’s often misunderstood, neglected, or outright feared. As powerful as pricing is, it’s also one of the only growth levers that can have catastrophic effects if handled poorly.

If optimising your pricing isn’t part of your regular growth activities, you’re leaving significant revenue on the table. Pricing doesn’t just work—it’s incredibly effective. A Price Intelligently study of 500+ SaaS companies found that monetization has the biggest impact on business growth—outperforming acquisition and retention strategies.

If you’re a SaaS founder, CEO, or revenue leader, optimising your pricing is the key to unlocking untapped growth. And it’s not something to revisit every three years—it’s something you should refine consistently, year-round.

The idea of changing pricing can be daunting—it’s one of the few levers that could backfire spectacularly. Thankfully, there’s a way to mitigate the risks: pricing experiments. Simply put, experimenting with pricing involves showing a portion of new customers a different version of your pricing, analyzing how it performs, and then either iterating further or rolling out the changes to all customers.

This guide will walk you step-by-step through how to use pricing experiments to systematically optimise your SaaS pricing strategy while avoiding common pitfalls. Let’s dive in.

Why you may consider listening to me

I’ve been in your shoes. I’ve grown SaaS companies, navigated pricing challenges, and set up internal pricing teams. I know firsthand how daunting and critical pricing decisions can be.

When I was running Toggl, we implemented several successful pricing changes. As our product’s value grew, we were able to double our prices multiple times. But as we scaled, the market turned into a red ocean—saturated with competition and mounting pricing pressure. Suddenly, no one on the team felt confident about pushing through another price hike.

We brainstormed and came up with some strong hypotheses—some incremental, others completely radical. But when we looked for tools to help test our pricing hypotheses, we hit a wall. The existing A/B testing platforms weren’t up to the task. They lacked any meaningful integration billing systems and didn’t offer neccessary safeguards to ensure customers within the same organization always saw consistent pricing.

That’s when I founded Potio. I took everything I learned from running SaaS companies and advising startups on pricing strategy and distilled it into a platform designed to enable pricing experimentation. With Potio, SaaS companies can optimise their pricing rapidly and safely, running pricing experiments without the overhead of figuring it all out internally or investing in a full-fledged pricing team.

Why experiment with prices?

Pricing often feels like a double-edged sword: raise prices, and you risk losing customers but earn more from those who stick around; lower prices, and you attract more customers but sacrifice revenue and margins on each sale.

Naturally, it would be valuable to know in advance which direction to take—or how far to push in either direction. This uncertainty around pricing changes can be paralyzing, and if you’re just winging your pricing changes, it absolutely should be. Pricing is one of the few growth levers that can go catastrophically wrong, and recovering from a pricing misstep is no easy feat.

You can strategize, consult pricing experts or conduct pricing research, but at the end of the day, the proof is in the pudding: if customers enter their credit card details and press pay, your pricing works. If they don’t, no amount of theoretical research can make up for an unsuccessful pricing launch.

Pricing experiments are your safety net against disastrous decisions. They’re also your path to unlocking the full potential of your pricing strategy.

Setting pricing optimization goals

Before diving into pricing experiments, ask yourself a simple but crucial question: What do you want to achieve?

I’ll give you two goals to consider—one that’s probably obvious, and another that often gets overlooked.

1. Improve your bottom line

This one’s a no-brainer. You want to grow revenue. You’re here because you know pricing can drive that growth. There’s no need to overexplain this—if you’re reading this guide, you’re already thinking about your bottom line.

2. Learn what works and what doesn’t

Here’s the goal that many miss: changing pricing to learn what works and what doesn’t.

If you’re accustomed to updating your pricing every few years in one big swoop, you’re probably not gaining much insight from the process. Bundling multiple changes into one rollout makes it impossible to know which specific adjustments are driving growth and which aren’t.

Is your SaaS ready for pricing experiments?

This handbook is written specifically for SaaS companies. If you’re acquiring 50+ new customers or trials monthly, you’re likely in a good position to start running pricing experiments and achieve statistically significant results.

With 50+ new customers you can run one pricing experiment every few months. If your numbers are a lot higher than these you might only have to run experiments for a few weeks and if your acquisition numbers are lower, you may need to extend your testing periods to gather enough data for reliable conclusions. Google Statistical Significance Calculator if you want to play around with the sort of numbers you might need.

Which pricing metrics should you track?

When testing new pricing strategies or running pricing experiments, it’s essential to monitor a wide range of revenue metrics. Don’t get tunnel vision. Just because one metric looks great doesn’t mean there aren’t negative side effects lurking elsewhere. Take a holistic view by including both short-term and long-term metrics to fully understand the impact of your pricing changes.

Key revenue metrics to track

(Not all of these will apply to every SaaS business, but they’re a good starting point.)

- Visitors: Useful for sanity checking that your test group sizes are correct.

- Signups: Pricing can affect the conversion rate from visitor to signup.

- Trials started: Ideally, you’d also track which plans people choose for trials.

- Signup to trial ratio: The percentage of signups that convert into trial users.

- Number of paid subscriptions started: A critical measure of how many users convert to paying customers.

- Number of payments made: Are you generating more or less revenue from fewer or more payments?

- Paid conversion: The percentage of trials or signups that convert into paying customers.

- Total revenue: Total revenue collected during the test period.

- ARR: The most important metric for recurring revenue businesses.

- ARPU: A measure of revenue efficiency per customer.

- Churn: Tracks customer retention. Even slight increases in churn can nullify revenue gains from an otherwise successful pricing change.

- Predicted LTV: Helps assess the long-term impact of pricing changes.

- Plan distribution: The split of users and revenue across your different pricing plans.

Having an easy way to visually track and compare these metrics is a game-changer. Dashboards that consolidate this data in real-time can save you hours of manual analysis and ensure you don’t miss any critical trends or anomalies.

How useful is pricing research?

Pricing research comes in all shapes and sizes—some helpful, some not so much. Let’s break down the most common methods and how useful they are in practice.

Pricing research to gauge willingness to pay (WTP)

In my experience, this kind of research is mostly... well, misleading. While it can be tempting to try and predict optimal price points this way, the results rarely align with how customers behave in the real world. What people say they’re willing to pay rarely matches what they’ll actually pay when it comes down to it. Even if pricing research identifies a seemingly “optimal” price, you may find in practice that customers are willing to pay significantly more. This disconnect is why I don’t recommend spending time on WTP studies.

If you’re curious, here are some popular WTP methods:

- Van Westendorp Price Sensitivity Meter: Ask customers what they think is an acceptable price range, then plot it on a cool-looking chart.

- Gabor-Granger Technique: A direct approach where customers are asked how likely they are to buy at different price points.

Pricing research to understand packaging

This is where things get interesting. If your product has a wide range of features and caters to diverse user profiles, research on packaging can be a goldmine. It helps you figure out which customers value what, ultimately allowing you to design packages that better meet their needs.

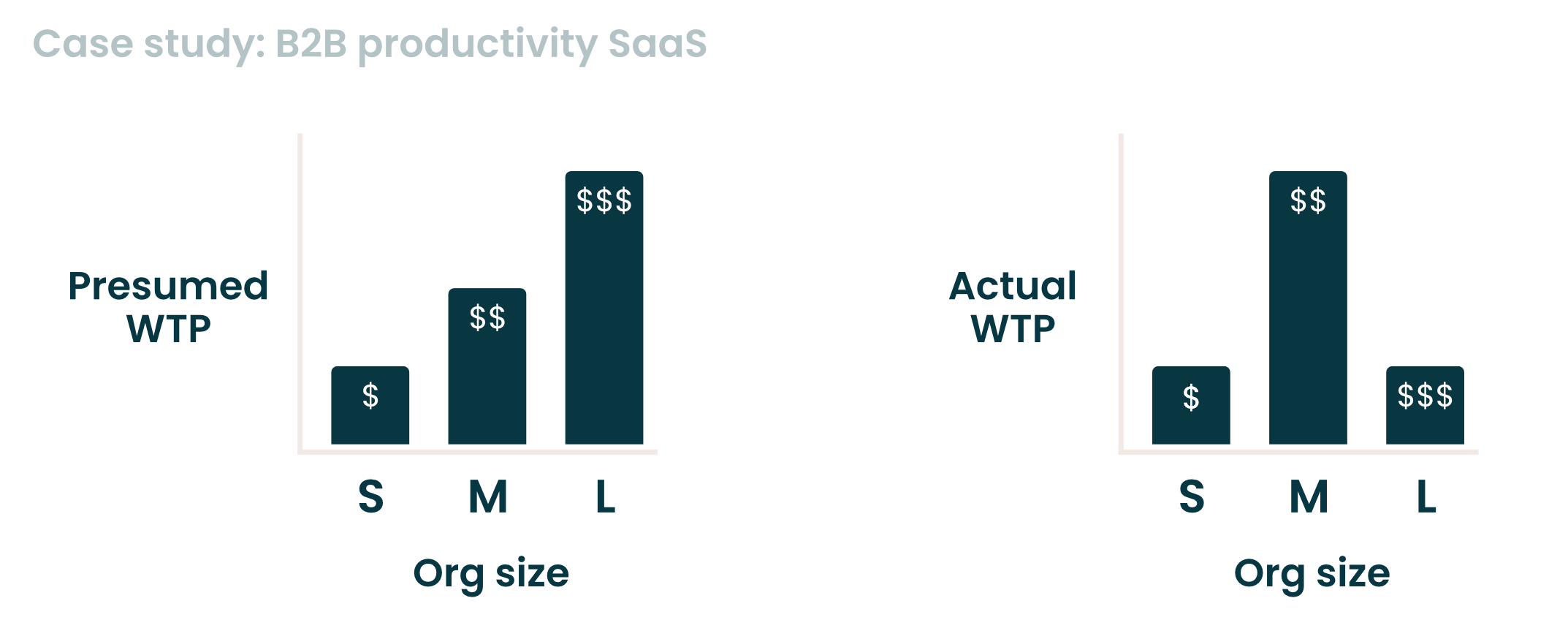

Case study: B2B productivity SaaS

Here’s a real-world example: I once worked with a popular B2B SaaS in the productivity space. They had three per-seat pricing plans: cheap, normal, and expensive. The assumption—and their sales pitch—was that larger organizations would naturally gravitate toward the pricier plans.

But when we dug into the research, it flipped this logic on its head. Small teams leaned toward the cheaper plan, as expected, because they didn’t need advanced features. But here’s the twist: large enterprises also preferred the cheapest plan. Why? They already had internal tools that replaced the advanced reporting features in the more expensive plans. It turned out the most expensive plan was actually the sweet spot for mid-sized teams that lacked those internal capabilities.

Here are some popular methods for packaging:

- Conjoint Analysis: A statistical method to determine how customers value specific product attributes and their impact on willingness to pay.

- MaxDiff analysis: A survey technique that asks customers to choose the most and least important features from a set. Provides a ranked list of feature importance.

Talking to your sales and customer success teams.

When it comes to pricing, the most valuable insights are often right under your nose. Talk to the people who interact with your customers daily—sales, customer success, and support teams. They hear the unfiltered truth about what customers want, need, and struggle with.

Make it a habit to gather their feedback regularly, and you’ll uncover insights that no survey or fancy statistical method can match. Simple? Yes. Effective? Absolutely.

Stop obsessing over competitors’ pricing

Looking at your competitors’ pricing is often the first thing companies do when setting or adjusting their own. But it's a lousy starting point, and here’s why:

- There’s no guarantee your competitor’s pricing is effective. Just because it looks polished doesn’t mean it’s working for them or will work for you.

- It encourages a race to the bottom. In the context of pricing, if you’re not innovating with your pricing structure, you’re essentially competing on price points alone. Undercutting your competition might seem like a good idea, but it often devalues your offering. Instead, focus on crafting a pricing structure that aligns with your customers’ needs and the value you provide.

- It limits creativity. Focusing too much on what others are doing can trap you into thinking “inside the box” instead of exploring innovative pricing strategies that better suit your product and customers.

Rather than obsessing over competitors, prioritize your own market fit. If their pricing truly affects your bottom line, you’ll hear about it through customer interviews or feedback from your sales team. If you’re not hearing this, their pricing is probably less of a threat than it seems when you’re scrolling through their website.

What should you experiment with?

Most people focus solely on the price point—primarily raising prices in hopes of earning more. Pricing experts would argue that the real opportunity lies in your pricing structure, not the numbers on the page.

The truth is that both are important, and taking a holistic view of your pricing strategy is crucial. Price hikes aren’t the only lever you can pull, but they’re definitely one you can consider. There’s much more to explore when experimenting with pricing.

Here are some ideas to get started:

- Lowering prices or adding lower price points: Attract more customers, enhance conversion rates, and improve retention by meeting the needs of price-sensitive segments.

- Reconfiguring features across plans: Make premium offerings more compelling or increase the perceived value of basic plans by redistributing features.

- Introducing new pricing tiers: Anchor existing plans or target diverse customer profiles with additional options that better fit their needs.

- Renaming plans: A simple but impactful way to align your offerings with customer expectations and improve plan resonance.

- Changing pricing models: Experiment with shifts like moving from per-seat pricing to usage-based pricing, hybrid models, or other innovative approaches.

- Offering annual discounts: Providing discounts for longer-term commitments can reduce churn, improve retention, and give you more revenue upfront.

By broadening your focus beyond price points, you’ll uncover ways to better serve your customers while optimizing your revenue potential.

Behavioural pricing

Behavioural pricing is the practice of understanding and leveraging psychological, emotional, and behavioral traits to influence how customers perceive and interact with your pricing. Instead of relying purely on economic logic, behavioural pricing taps into how customers make decisions in the real world—decisions that are often far from rational.

By incorporating behavioural insights into your pricing strategy, you can subtly guide customers toward choices that are better for both them and your business. This approach goes beyond price points, focusing instead on how your pricing is framed and structured.

A few examples of behavioural pricing tactics

- Compromise pricing: Customers often gravitate toward the middle option when faced with extremes. If you currently only offer two pricing tiers, consider adding a mid-tier option (or a new more expensive tier) as a "safe" compromise, nudging customers away from the cheapest tier.

- Anchoring: Introduce a high-priced option to serve as a reference point, making other tiers appear more affordable and valuable by comparison.

- Decoy pricing: Introduce a less attractive option to steer customers toward a more expensive, but better value choice you want them to make.

These are just a few behavioural pricing tactics you can use to optimize your strategy. To learn more, check out our detailed breakdown of compromise pricing, anchoring and decoy pricing.

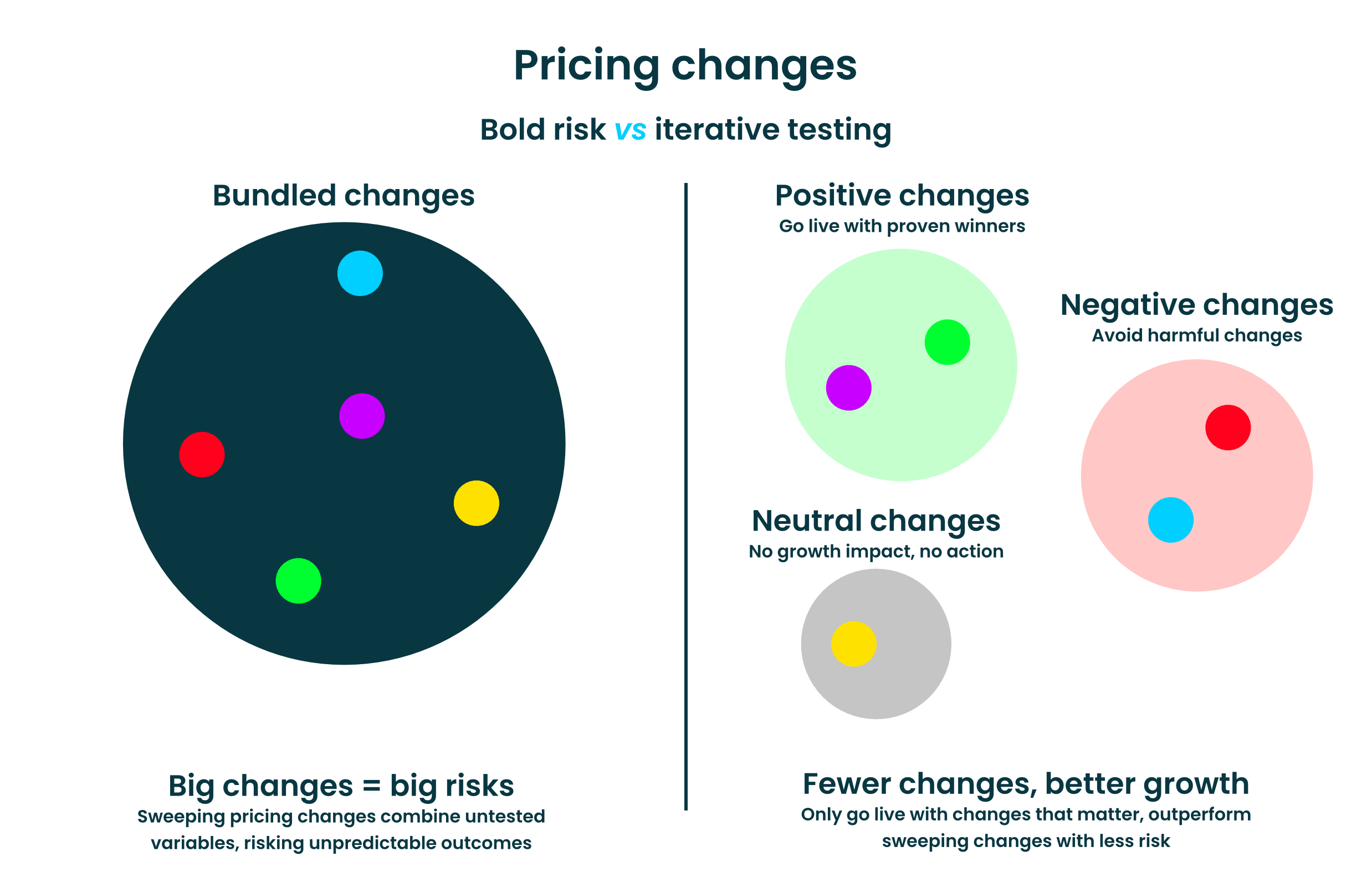

Pricing split testing: how to run the experiment

You’re finally ready to start experimenting. By now, you’ve hopefully grasped the importance of breaking large pricing changes into smaller, testable chunks. If not, let’s emphasize it again: smaller changes mean better insights. Making sweeping changes bundles too many variables, leaving you unsure of what worked and what didn’t. With small, focused experiments, you can isolate the impact of individual changes and learn what truly drives growth.

Start with your current live pricing

Your current live prices serve as your baseline pricing strategy—the control group for your experiment. Every pricing experiment you run should be compared against this baseline to ensure performance is measured under consistent conditions.

In SaaS, countless external factors can influence your metrics—improved onboarding flows, optimized ad campaigns, or seasonal trends. To eliminate these variables, it’s critical to run pricing experiments in parallel rather than in sequence. Running them simultaneously ensures that the data you collect is fair, accurate, and actionable.

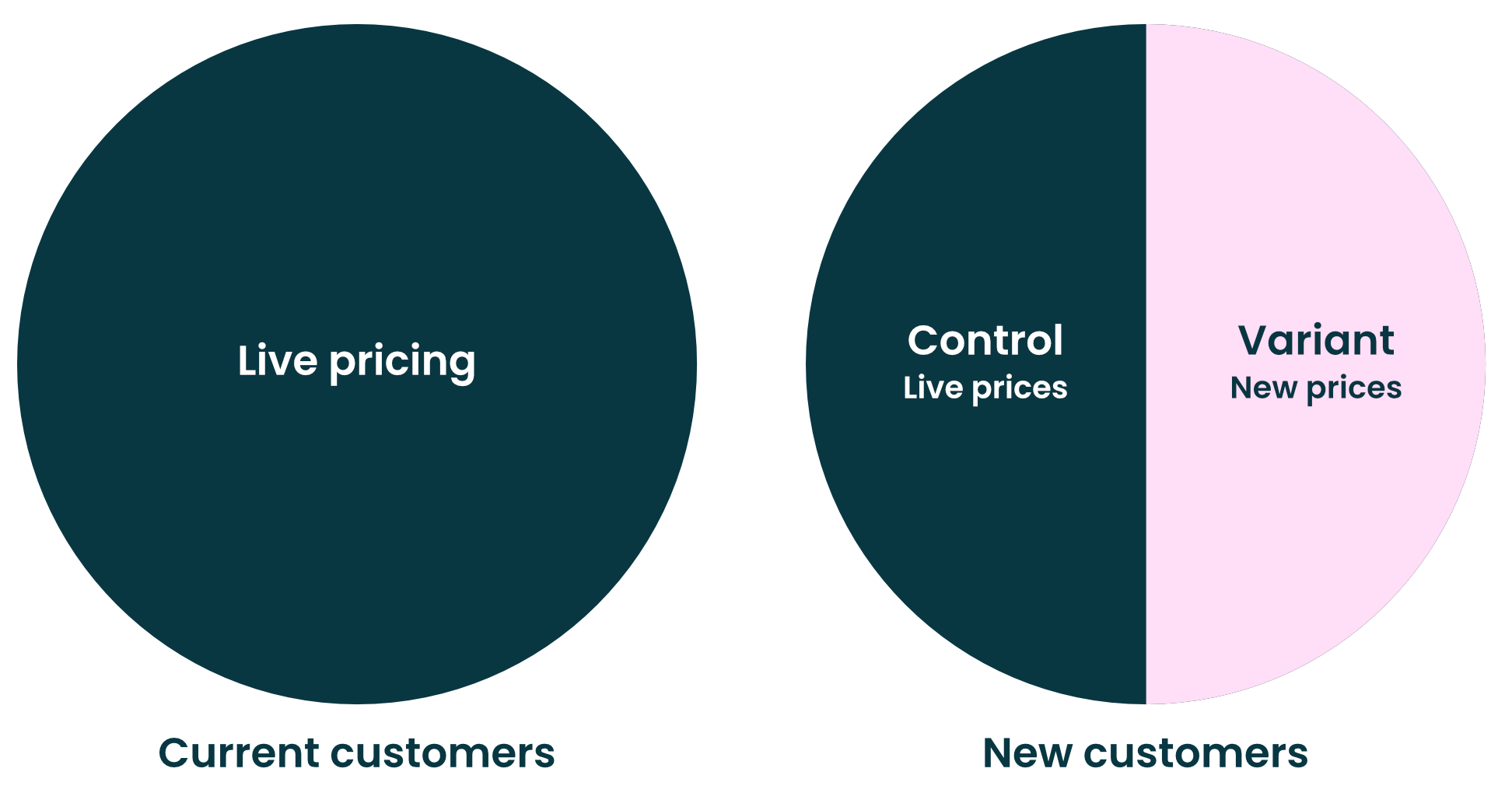

Testing with new users: a low-risk starting point

When running pricing experiments, always start by targeting new customers first. Prospects don’t carry any legacy expectations of your pricing, making them ideal test subjects. Testing on new users minimizes risks since they have no attachment to your previous prices.

Split incoming customers into two groups—control and variant. The control group sees your current live pricing, while the variant group gets the experimental pricing. Meanwhile, your existing customers remain unaffected, staying on their original pricing structures and shielded from the experiment.

Essential guardrails for running pricing experiments safely

Split testing pricing is a lot more delicate than A/B testing your website copy. Pricing experiments introduce technical complexities that regular A/B testing tools just aren’t built to handle. But these complexities are essential for running safe and reliable pricing experiments. Without these safeguards, you risk confusing customers and sparking frustration when they see prices that are inaccessible to them.

What you need to get right:- Consistency between public and in-app pricing: The prices on your public pricing page must match what customers see in their billing portal.

- Existing customers must not see new prices: Keep your current users on their original pricing—shielding them from experiments ensures stability and avoids unnecessary confusion.

- New customers should see only their assigned pricing: Control group gets the old pricing, variant group sees the test pricing—no switching, no overlap.

- Uniform pricing for entire organizations: Make sure everyone within the same company sees the same pricing. You can achieve this by connecting the experiment to their organisation (instead of visitor session) as well as their IP (customers from same office can use the same IP).

If you’re struggling to implement these guardrails, Potio has all of this baked in. Reach out, and we’ll help you get started.

How to split test your pricing

Experiment in small iterations where possible

Pricing experiments should ideally be small. Sometimes, this isn’t possible—for example, when transitioning from per-seat pricing to usage-based pricing. But in most cases, companies tend to needlessly bundle a lot of small changes together, pushing them out every few years.

Making big changes makes it hard to conclude what exactly worked and what didn’t. Big pricing changes often bundle many smaller adjustments at once—adding features, shifting features between tiers, creating new plans, and raising prices.

Let’s say you made 20 small changes in one go, and you hit your revenue goals. Great! But what drove that growth? Which specific changes made the difference, and which were just noise? Worse, which changes might have been detrimental?

From my experience, it’s highly unlikely that all 20 changes were effective. More often, the results look like this:

- 5 changes drove growth.

- 13 changes didn’t affect growth but some added complexity.

- 2 changes actually hurt your growth.

If you had tested and rolled out just the 5 effective changes, your growth would have been even stronger—and your pricing structure likely simpler. The only way to pinpoint these high-impact changes is by experimenting iteratively with smaller, focused adjustments. Break it down, test each hypothesis, and let the results guide you.

Going live with new pricing

You’ve tested your new pricing strategy, seen it work its magic, and now it’s time to roll it out to all your customers. This is a big moment. You might write a blog post announcing the changes, and maybe you’ll even grandfather existing customers for a limited time. But eventually, you’ll need to transition everyone to the new pricing.

When to push new prices on existing customers

When you’re running pricing experiments continuously (say, one experiment per month), you don’t want to bother your existing customers with constant price changes. A good rule of thumb is to avoid changing prices for existing customers more than once a year. Instead, bundle together a set of successful small changes and roll them out as a single update.

Expect pushback—but don’t panic

Here’s the reality: pricing changes always trigger negative feedback. It’s normal. It’s expected. And it’s something you should mentally prepare for.

The first few weeks will be the loudest. You’ll hear complaints, and it might feel tempting to backtrack. Don’t do it. A knee-jerk reaction to your customers’ knee-jerk reaction is the last thing you need. Instead, give it time. Monitor key pricing metrics, stay calm, and make data-driven decisions. Remember: you have hard evidence that the new pricing structure performs better—trust the data.

You will never hear your prices are too low

No matter what you charge, there will always be customers who think your prices are too high. It’s inevitable. But here’s what you won’t hear: “Hey, your prices are way too low!”

This is why you can’t rely solely on customer feedback to validate pricing decisions—you need to pair it with hard data. Customers evaluate pricing based on the value they perceive, and not every customer will see that value the same way. What really matters is that your ICP sees immense value in what you’re offering. It’s natural for those outside your ICP to perceive less value—and that’s okay.

What to do if pricing complaints pile up

If you’re seeing an unusual amount of negative feedback, it might be worth revisiting your pricing structure, especially fencing.

Fencing is the practice of segmenting customers into different user groups based on their needs, behavior, and willingness to pay. Different segments derive different levels of value from your product—and the way they’re used to paying for software may vary as well. If you’re getting significant pricing pushback, it’s often a sign that your current pricing structure isn’t effectively differentiating between these groups.

Instead of immediately lowering prices in response to complaints, consider adjusting your fencing strategy—this could mean:

- Introducing new tiers for price-sensitive customers

- Adjusting feature access across plans to better align with different customer needs

- Offering volume discounts or enterprise deals for larger accounts

The goal isn’t to please everyone—it’s to price strategically so each ICP can easily find a tier that fits their needs.

Conclusion

By now, you should have a solid understanding of why and what it takes to start running pricing experiments for your SaaS. I hope this handbook has shown you how powerful pricing can be and helped you see it as an active growth channel, rather than an afterthought.

Yes, you can absolutely build a pricing experimentation framework in-house. At Toggl, we assembled a team of four people (one growth manager and three developers) and spent six months setting up the technical groundwork to start experimenting. It wasn’t perfect—it was a bit jerry-rigged but it got the job done. If you’re nimble, you might pull it off faster. Larger companies may need more time and resources to get there.

I know it’s a big ask. Building pricing experimentation in-house requires serious commitment. But there’s another option: Potio. I built Potio specifically to solve this problem because nothing else on the market makes pricing experimentation simple for SaaS companies. With Potio:

- Your revenue team can run experiments continuously with minimal (or no) developer involvement.

- Potio takes care of all safeguards, ensuring every customer sees the right pricing version.

- You can hit the ground running in year one and see double or even three digit ARR increases year one.

- Potio handles all the technical heavy lifting, including building paywalls and pricing pages, ensuring the right customers see the correct prices, and integrating deeply with your payment provider to display advanced analytical data.

Ready to unlock your pricing potential? Book a consultation with me directly, and let’s explore how we can optimize your pricing strategy together.

Books to read

If you’re only going to read one book, make it The Pricing Roadmap by Ulrik Lehrskov-Schmidt. It’s packed with actionable insights and real-world examples from one of the smartest minds in SaaS pricing. It’s an absolute must-read for anyone serious about mastering pricing.